Vancouver, British Columbia / November 17, 2022 – US Critical Metals Corp. (“USCM”) (TSXV: USCM, OTCQB: USCMF; FSE: 0IU0) and Idaho Silver Corp. (“Idaho Silver”), a private company existing under the laws of British Columbia (collectively, the “Parties”) are pleased to announce the Parties have entered into a share purchase agreement dated November 16, 2022 (the “Agreement”) whereby USCM will acquire 70% of the issued and outstanding common shares of 1212242 B.C. Ltd. (“B.C. Ltd.”), a private company existing under the laws of British Columbia, with the remaining 30% being held by Idaho Silver (the “Transaction”).

Upon closing of the Transaction, B.C. Ltd. will be the sole owner and shareholder of Long Canyon Resources Inc. (“Long Canyon Resources”), an Idaho corporation, which will be the holder of the Long Canyon Uranium and Vanadium Project (“Long Canyon” or the “Project”). Long Canyon is comprised of 25 contiguous unpatented mining claims and two non-contiguous unpatented mining claims in the state of Idaho and covers a surface area of approximately 535 acres. The 25 contiguous unpatented mining claims are situated on land administrated by the Bureau of Land Management. The two non-contiguous unpatented mining claims are situated on land administered by the United States Forest Service.

Transaction highlights include the following:

- Expands the portfolio of USCM’s assets to include energy metals and provides further optionality and diversification to shareholders. USCM will evaluate strategic alternatives for Long Canyon upon qualifying the Project.

- Positions USCM with another high potential asset in the state of Idaho, a leading mining jurisdiction within the US.

- Further expands the network of technical relationships available to USCM. Principals of Idaho Silver have extensive operating experience and exploration success within the state of Idaho which USCM is able to leverage to bolster the potential success of the Project moving forward.

- Limited upfront cash cost reduces the acquisition risk and potential dilution for USCM shareholders.

The Transaction is at arms-length and expected to be an expedited transaction pursuant to TSX Venture Exchange (“TSXV”) Policy 5.3 – Acquisitions and Dispositions of Non-Cash Assets. Closing of the Transaction (“Closing”) is subject to receipt of applicable regulatory approvals and third-party consents, including the approval of the TSXV and closing conditions customary for transactions of this nature, on or before January 31, 2023.

Property Description

Regional geological mapping by the Idaho Geological Survey indicates the presence of the Phosphoria Formation on the Project, a Permian sedimentary unit known to host elevated to economic levels of phosphate, uranium, vanadium, and other metals throughout parts of Idaho and Utah. The Property is also prospective for limestone-hosted mineralization (Mississippi Valley Type (MVT)) or Carbonate-hosted Replacement Deposits (CRD)) with strongly elevated silver, lead and zinc values. Anomalous to strongly elevated copper, molybdenum, nickel and cobalt values occur as well. The area was previously explored in the 1950s.

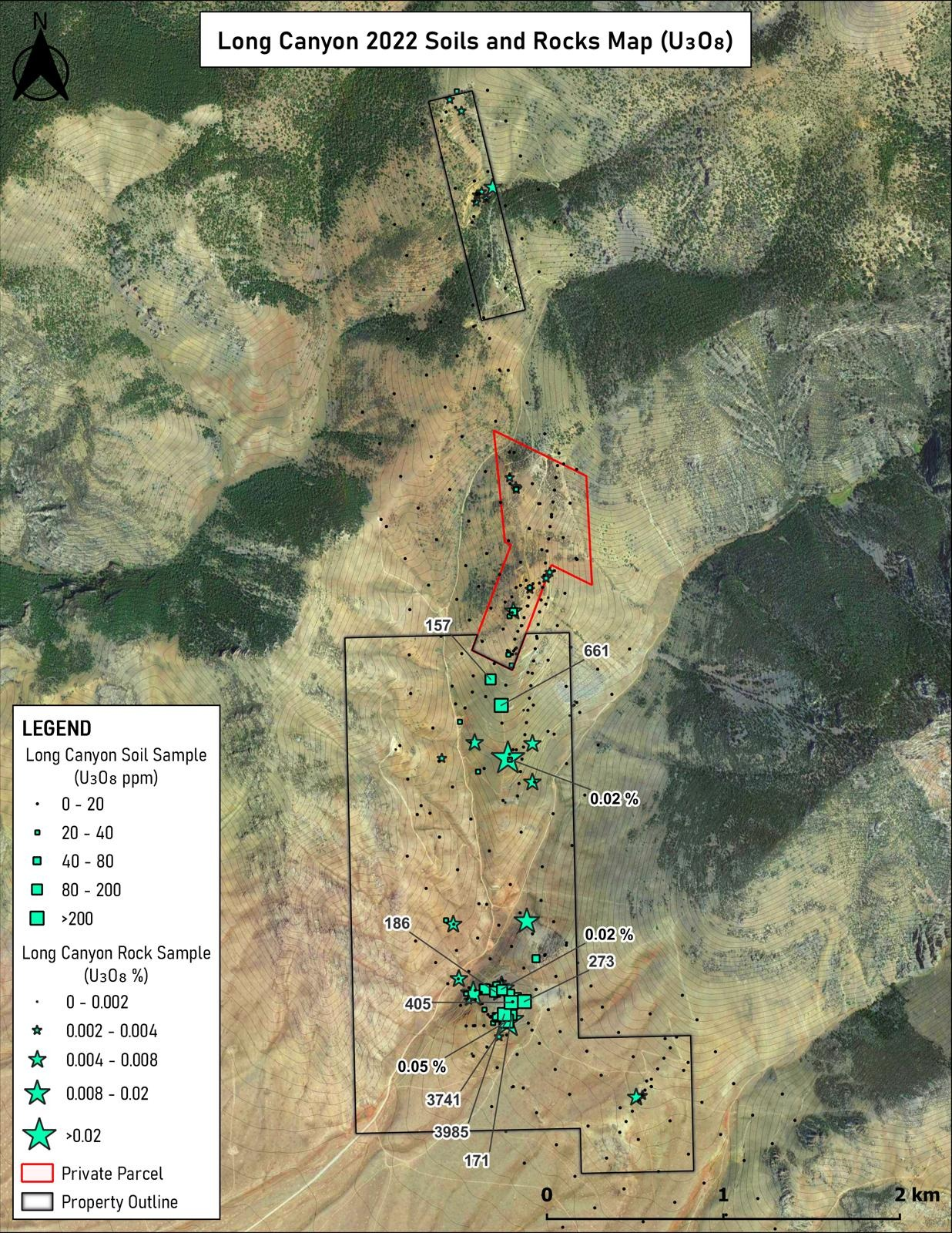

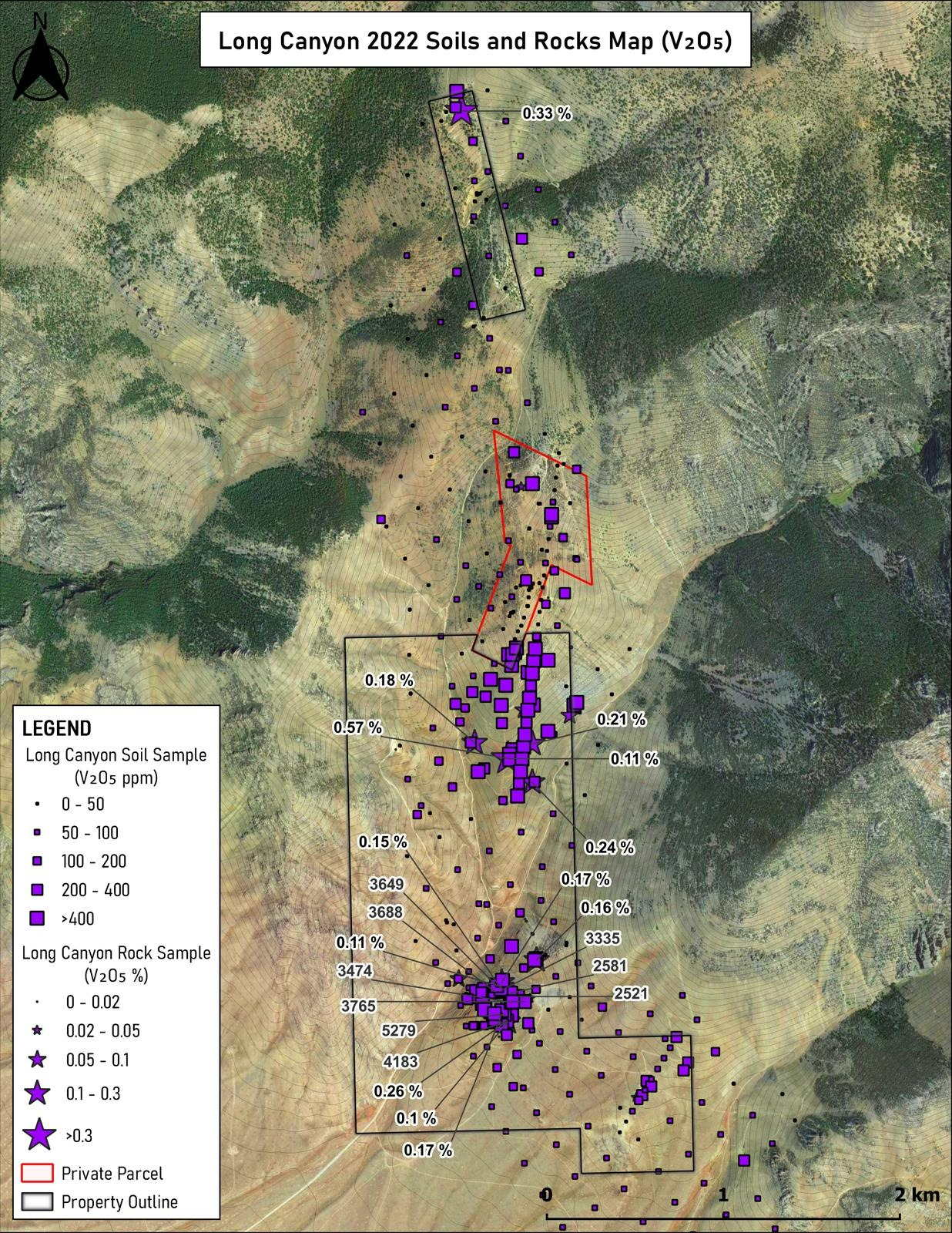

The property has had three phases of geochemical sampling completed from 2020 through 2022, all of which have returned highly anomalous grades. This previous work completed by Idaho Silver included 70 rock and chip and 383 soil samples and returned the following values:

- Uranium up to 521 ppm (average of 32 ppm) in rock chip and grab samples and 3,985 ppm (average of 29 ppm) in soil samples (Long Canyon 2022 Soils and Rock Map U3O8).

- Vanadium up to 0.7% (average of 293 ppm) in rock chip and grab samples and 5,279 ppm (average of 159 ppm) in soil samples (Long Canyon 2022 Soils and Rock Map V2O5).

- Nickel up to 0.17% (average of 256 ppm) in rock chip and grab samples and 5,957 ppm (average of 188 ppm) in soil samples.

- Molybdenum up to 0.48% (average of 331 ppm) in rock chip and grab samples and 6,969 ppm (average of 101 ppm) in soil samples.

- Lead up to 9.4% (average of 0.55%) in rock chip and grab samples and 290,700 ppm (average of 2,093 ppm) in soil samples.

- Zinc up to 1.5% (average of 0.16%) in rock chip and grab samples and 15,400 ppm (average of 561 ppm) in soil samples.

The reader is cautioned that rock grab samples are selective by nature and may not represent the true grade or style of mineralization across the Property.

The maps below summarize the uranium and vanadium rock and soil samples taken from the Project:

Terms of the Transaction and Closing

Pursuant to the Agreement, the USCM will purchase in aggregate 70% of the issued and outstanding shares of B.C. Ltd. from Idaho Silver as follows:

- in consideration for 45% of the issued and outstanding shares of B.C. Ltd., USCM will make a payment of $50,000 in cash to Idaho Silver and issue 1,000,000 common shares (the “Consideration Shares”) to Idaho Silver at a deemed price of $0.35 per Consideration Share;

- in consideration for 25% of the issued and outstanding shares of B.C. Ltd., USCM will subscribe for 8,000 common shares for aggregate proceeds of $200,000.

At Closing, Long Canyon Resources will also enter into a net smelter return royalty agreement (“NSR Royalty Agreement”) with Idaho Silver, which grants Idaho Silver a perpetual three and one-half percent (3.5%) royalty (the “NSR Royalty”) relating to all production from the Long Canyon Property. The NSR Royalty is subject to a buyback right in favor of B.C. Ltd. pursuant to which B.C. Ltd. may repurchase up to 2% (in whole or part) of the NSR Royalty for a price equal to $2,000,000 ($1,000,000 for each 1% instalment).

The Consideration Shares will be subject to a statutory hold period under applicable Canadian securities laws which will expire four months and one day after issuance.

Management Commentary

Mr. Darren Collins, CEO and Director of USCM, comments: “This Transaction with Idaho Silver further exemplifies our company’s ability to source, evaluate, structure and execute on property acquisitions that we believe will create value to USCM shareholders. Long Canyon further expands our commodity exposure, provides additional portfolio optionality, brings new technical relationships and shareholders to the Company. This transaction rationale further advances our core objective of making meaningful discoveries to advance US interests. I would like to thank all the parties involved in bring this Transaction together and look forward to further bring a relationship with our new partner and shareholder, Idaho Silver.”

Mr. Clayton Fisher, CEO and Director of Idaho Silver, comments: We’re excited to bring in a strong partner like USCM to further advance the Long Canyon uranium-vanadium project in eastern Idaho. Long Canyon represents a unique polymetallic energy metals play, which hosts a full suite of prospective metals in addition to strong primary uranium and vanadium. Being well situated on BLM ground in eastern Idaho allows for quick and easy drill permitting. Despite the fact that small-scale uranium mining took place on the property throughout the 1950s, it has seen little to no modern exploration. This new partnership strengthens our uranium exposure and supports our focus of partnering good projects with strong groups. We look forward to continuing to collaborate with USCM as we further unlock the value of this overlooked uranium camp in the United States.”

Qualified Person

The scientific and technical information contained in this news release about the Long Canyon property has been reviewed and approved by Robert J. Johansing, BSC. geology, MSc economic geology, who is a qualified person as defined in NI 43-101 (the “QP”). The QP has not done sufficient work to confirm the historical sampling by Idaho Silver.

Quality Control and Quality Assurance

All soil and rock samples were prepped and analyzed at MSA Labs in Langley, British Columbia, an ISO 17025 and ISO 9001 certified laboratory. Rock samples were dried, crushed and sieved to 70% passing 2mm; a 250 gram(g) split was pulverized to 80% passing 75 microns. Soil samples were dried and sieved to -180 micron (80 mesh). Following preparation, soil and rock assays were determined by the IMS-131 method. A 20g aliquot of the prepared pulp was cold-digested with HNO3, then HCl is added, and the sample was heated at 130˚C for 40 minutes. Digestion was carried out in disposable plastic bottles to eliminate cross-contamination from digestion vessels and heated via graphite block for even heating. The resulting solution was analyzed via ICP-MS and ICP-ES for 51 elements and was corrected for inter-element spectral interferences.

Blind certified reference materials (CRMs) and duplicate soil samples were inserted at a frequency of approximately 1 in every 25 samples. Duplicate soil samples were prepared in the field by homogenizing soil collected at a specific sample site and placing it in two soil sample bags in sequence. CRM results for copper, silver, lead and zinc were all within acceptable limits with no failures. CRMs for uranium and vanadium were unavailable and were not employed at Long Canyon. MSA Labs also employs internal quality control standards, duplicates and blank samples at set frequencies. Lab blanks showed no indications of contamination. Duplicate sample precision results were excellent.

About Idaho Silver Corp.

Idaho Silver Corp. is a British Columbia based property generator focused on identifying, staking, and sampling mineral exploration properties in the resource rich state of Idaho, USA. Projects within the company’s portfolio are diversified across various commodities and geological settings located around past producing mines from the late 19th and early 20th centuries. Idaho Silver seeks to establish collaborative exploration arrangements, with the ultimate goal of assembling a large, diversified portfolio of exploration and development projects with royalty interests.

About US Critical Metals Corp.

US Critical Metals Corp. is focused on mining projects that will further secure the US supply of critical metals and rare earth elements, which are essential to fueling the new age economy. Pursuant to option agreements with private Canadian and American companies, USCM’s assets consist of three agreements, each providing USCM with the right to acquire interests in four discovery focused projects in the US. These projects include the Clayton Ridge Lithium Property located in Nevada, the Haynes Cobalt Property located in Idaho, the Sheep Creek located in Montana, and Lemhi Pass located in Idaho. A significant percentage of the world’s critical metal and rare earth supply comes from nations with interests that are contrary to those of the US. USCM intends to explore and develop critical metals and rare earth assets with near- and long-term strategic value to the advancement of US interests.

For further information please contact:

Darren Collins

Chief Executive Officer & Director

Telephone: +1 (786) 633-1756

Email: dcollins@uscmcorp.com

Disclaimer for Forward-Looking Information

This news release contains certain information that may be deemed “forward-looking information” with respect to USCM within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause USCM’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur.

Although USCM believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with statements regarding, but not limited to: the ability of the Parties to satisfy the closing conditions under the Agreement; the equity interest USCM may hold in B.C. LTD.; the ability of Idaho Silver to transfer the Properties to Long Canyon Resources; the ability of USCM to make the required capital contributions under the Agreement; the ability to extract uranium and vanadium from the Properties; the market for uranium and vanadium; the classification of the transaction as an exempt transaction under TSXV Policy 5.3; and the control, management and operation of Idaho Silver.

The forward-looking information contained in this press release represents the expectations of USCM as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While USCM may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.